bear trap stock term

Therefore we need PRU to stage a short-term rally likely due to oversold technicals. The bear trap occurs when the bears find they must repurchase the shares from an individual or a group at an artificial price determined by the seller.

The Great Bear Trap Bull Trap Seeking Alpha

Hence a false reversal of a declining price trend can be described as the trap.

. What is a Bear Trap. Bear traps spring as brokers initiate margin calls against investors. Beware the Bear Trap Disguised as a Stock Rally.

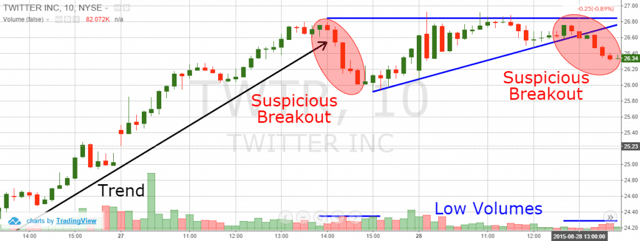

When this happens anyone who was betting on the stock to go down ends up losing money even if the. Notably a bear trap in May was invalidated demonstrating the potency of the markets bearish momentum. In general a bear trap is a technical trading pattern.

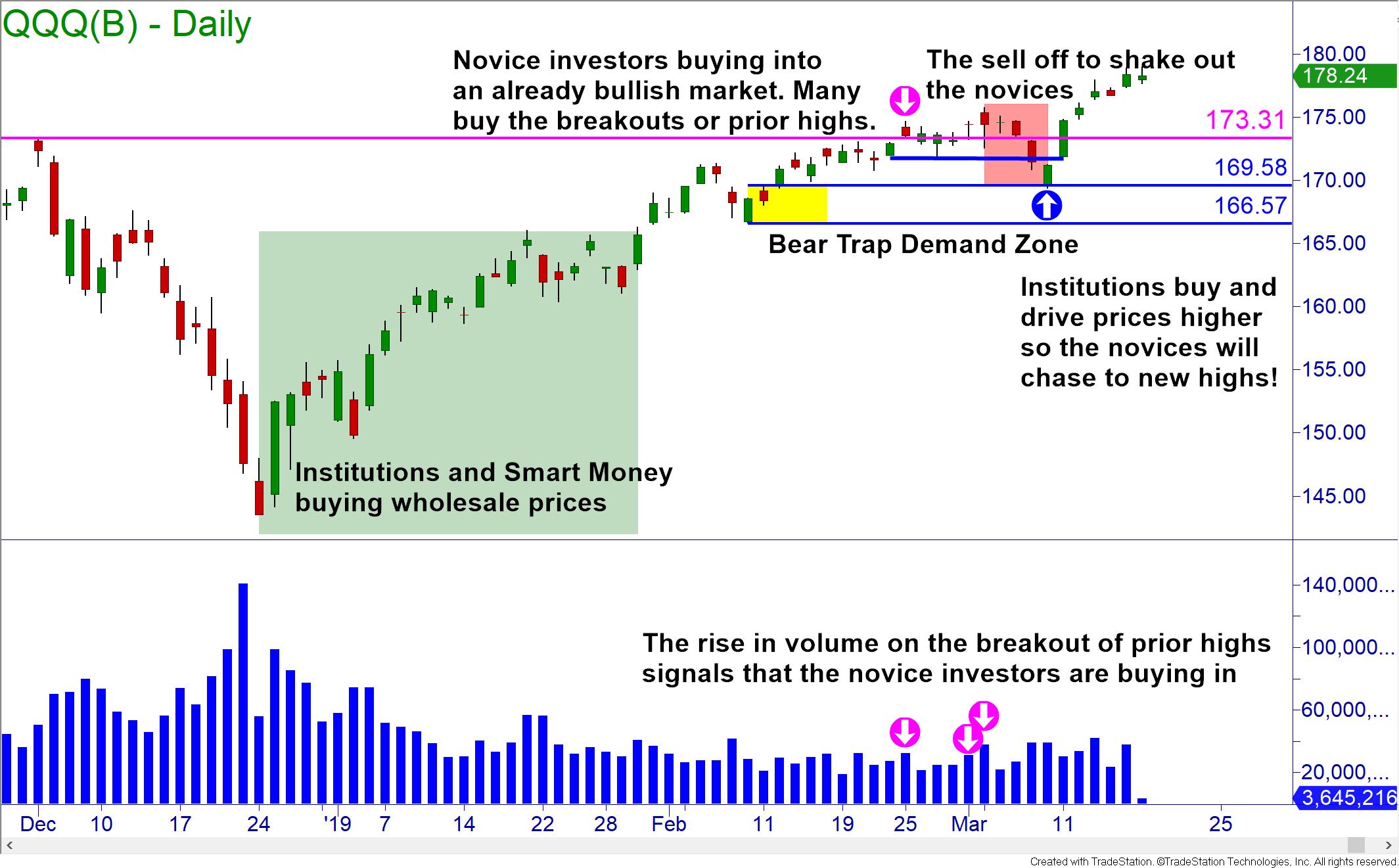

Essentially the bear trap is designed to encourage investors to buy at a higher price with the anticipation that during the. A bull trap is a false signal indicating that a declining trend in a stock or index has reversed and is heading upwards when in. When this happens bears who sold their shares.

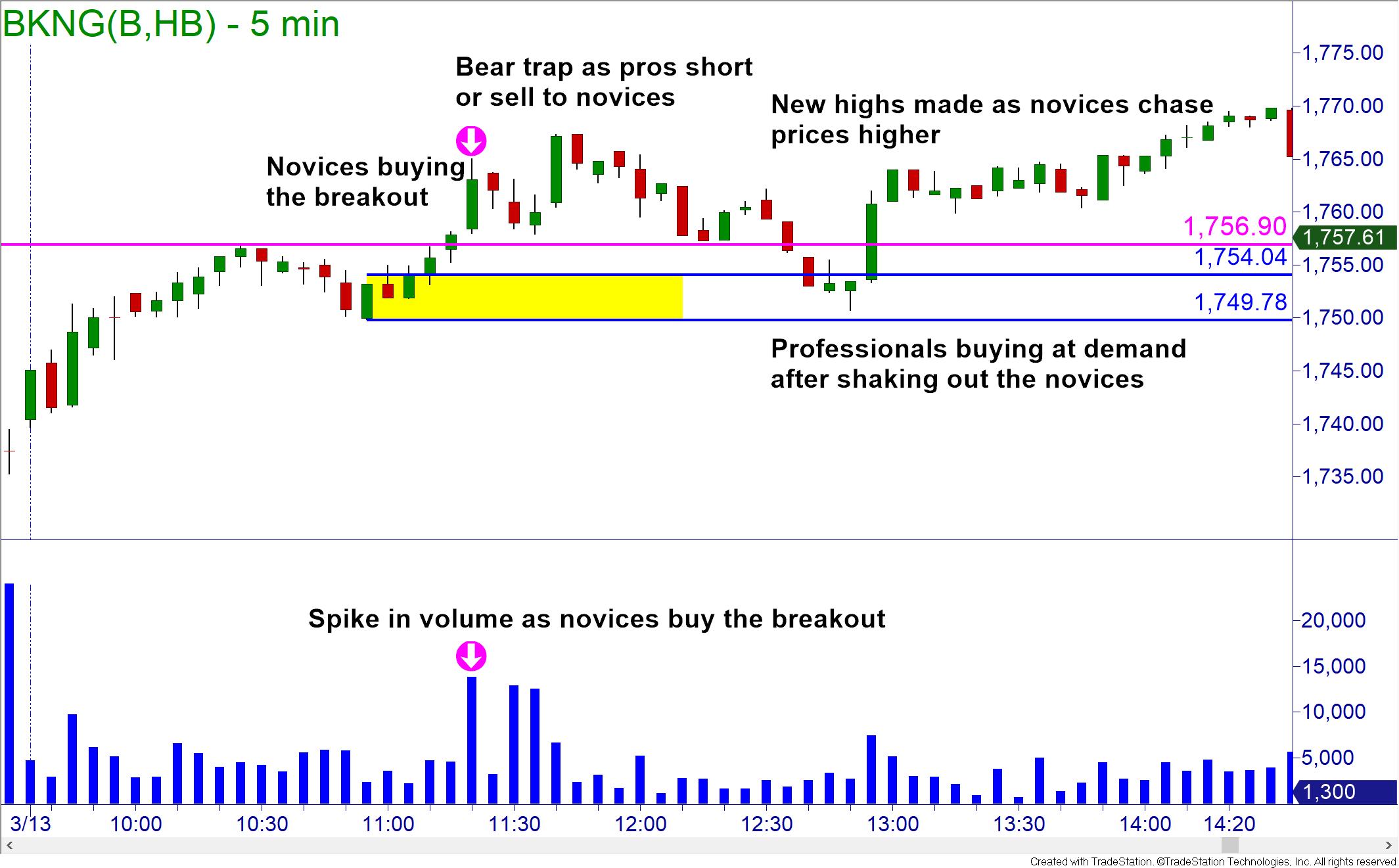

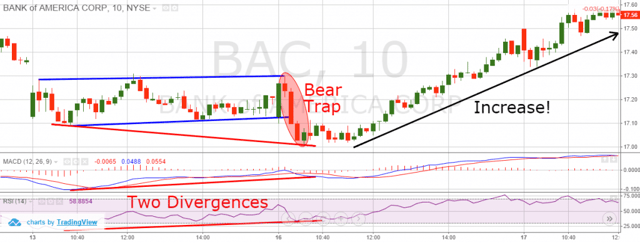

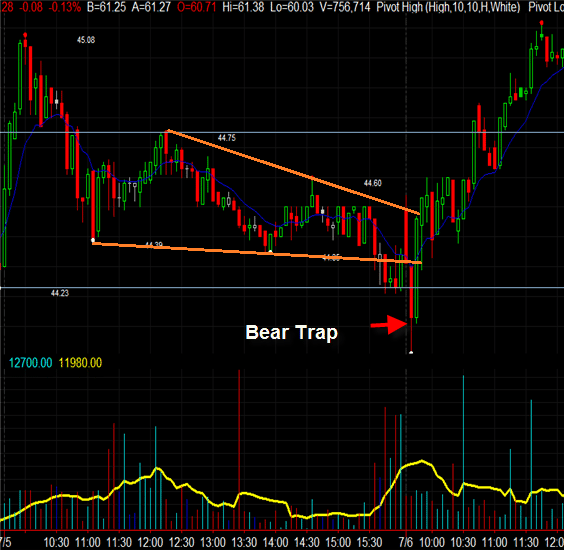

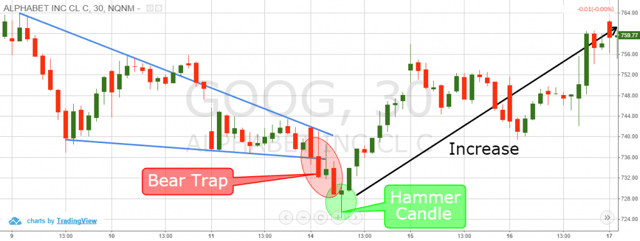

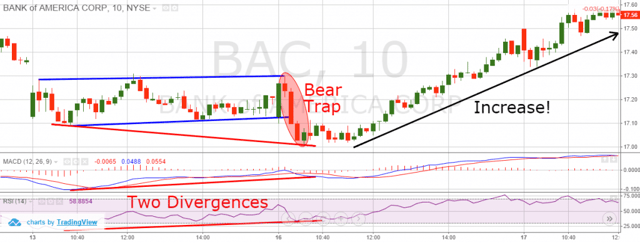

A bear trap or bear trap pattern is a sudden downward price movement luring bearish investors to sell an investment short followed by a price reversal back upward. Institutions must weed out amateurnovice traders in order to increase demand and drive stock prices upward. Bull traps and bear traps can be thought of as failed breakouts and.

Whether youre a pattern trader or just have a hunch about the trajectory of a stock price its important to understand what a bear trap is as well as how to identify and avoid one. Bear traps occur when investors bet on a stocks price to fall but it rises instead. A bear trap is a false selling signal that occurs when an equity that has been in a bullish pattern quickly breaks to the downside.

A bear trap stock is a downward share price that lures investors to sell short but then sharply reverses with the price moving positively. A Bear Trap is a device that is used to capture bears. This causes traders to open short positions with expectations of profiting from the assets price decline.

Bear traps typically follow bullish patterns. A bear trap is best-defined as a false reversal at the culmination of a pattern. Bear Trap Stock is a term used in the stock market to describe a particular type of investment.

When the performance of an index stock or other financial instrument incorrectly signals a reversal of a rising price trend a technical pattern that occurs this is known as a bear trap. Based on the anticipation of price movements which do not occur by bear traps investors can be tempted. A false signal which indicates that the rising trend of a stock or index has reversed when in fact i.

In the stock market traders depend on technical indicators to help them trade effectively. This is what happens when a stock or other security stops dropping and unexpectedly begins rising. Trading Bear Trap Explained.

If youre thinking about short-selling or have done any research you might have heard the term bear trap. Heres a closer look at bear trap trading. A Bear Trap occurs when a stock that has been declining suddenly reverses and starts to rise.

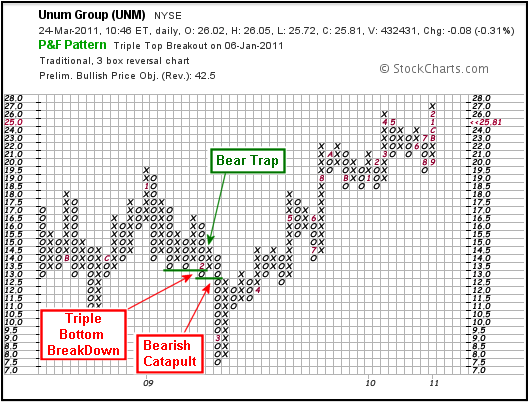

It can be a multi-bar formation like what you saw in the 15-minute chart. It is a false indication of a reversal from an uptrend into a downtrend. What is Bear Trap in the Stock Market.

However instead of continuing to fall the stock reverses and moves past its prior high. The Nasdaq Composite Index boomeranged 10 last. The predicament facing short sellers when a bear market reverses its trend and becomes bullish.

It is typically characterized by a bottoming tail candle like May 20th but it need not be. An accumulation of shares being sold short by bears trying to drive down the price of a stock. Vladimir Putin can still shock the market at any time and investors havent fully grasped what it will take to rein in the worst inflation in.

It happens when the price movement of a stock index or other financial instruments wrongly suggests a trend reversal from an upward to a downward trend. A bear trap is the opposite of a bull trap. Many investors who have been watching the stock decline will sell it at this point because they believe that the trend has reversed and the stock will continue to go down.

There are many ways to lose money in down markets and buying fleeting rebounds is among the best. A bear trap is a trading term used to describe market situations that indicate a downturn in prices but actually leads to higher prices. While not an indicator a bear trap is a technical trend or pattern that can be seen when the price movement of a stock or any financial security signals a false reversal from a downward to an upward trend.

The creation of a bear trap involves the careful planning and execution of a set of circumstances in which there is sense of an impending short term fall in the price of a given security that will be followed by a long term upswing in the price. Rising stock prices cause losses for bearish investors who are now trapped Typically betting against a stock requires short-selling margin trading or derivatives. 39 minutes agoThis is in essence the pattern of a bear trap.

Investors and traders take short positions thinking that the rally is over. There are such things as bull traps as well but in reverse. What is Bear Trap.

They accomplish this by driving prices lower in order to create the illusion that the stock or market is turning pessimistic.

Bull Trap Vs Bear Trap How To Identify Them Phemex Academy

What Is A Bear Trap On The Stock Market Fx Leaders

What Is A Bear Trap On The Stock Market Fx Leaders

What Is A Bear Trap On The Stock Market

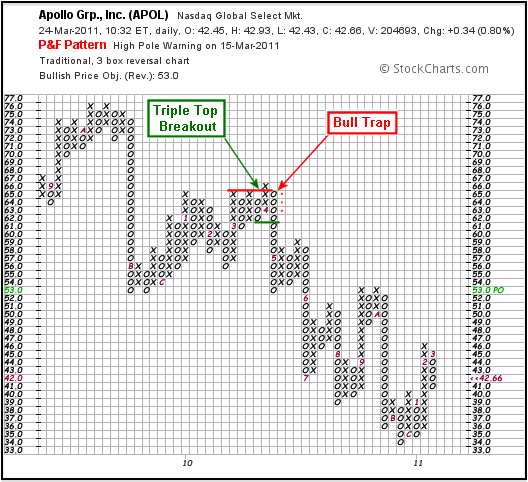

P F Bull Bear Traps Chartschool

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

P F Bull Bear Traps Chartschool

Bear Trap Stock Trading Definition Example How It Works

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

What Is A Bear Trap On The Stock Market Fx Leaders

What Is A Bull Trap In Trading And How To Avoid It Ig En

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

Bear Trap Explained For Beginners Warrior Trading

What Is A Bear Trap Seeking Alpha

Bear Trap Meaning What It Is And How Do Bear Traps Work

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

/Clipboard01-c2c4a2d12c05468184b82358f12a1af5.jpg)